This is part 2 of 3 posts on the roadblocks and bottlenecks California is facing in its transition to 100% clean energy. Read Part 1 about transmission needs and Part 3 about permitting challenges.

In my previous blog post, I wrote about California’s need to increase its transmission capacity for the clean energy transition. In this post, I’ll dive into the need to reform how clean energy projects connect to the grid.

To briefly set the stage again, California’s grid now generates 28% of its electricity from solar and wind resources, up from just 14% in 2015. It’s a big step, but the pace of getting these resources on the grid still needs to be faster. With current electricity generation capacity at about 88 gigawatts (GW), California needs to add between 7 and 8 GW annually over the next 20 years to reach its clean energy goals. In the past four years, California has added an average of under 4 GW per year.

How bad is the backlog?

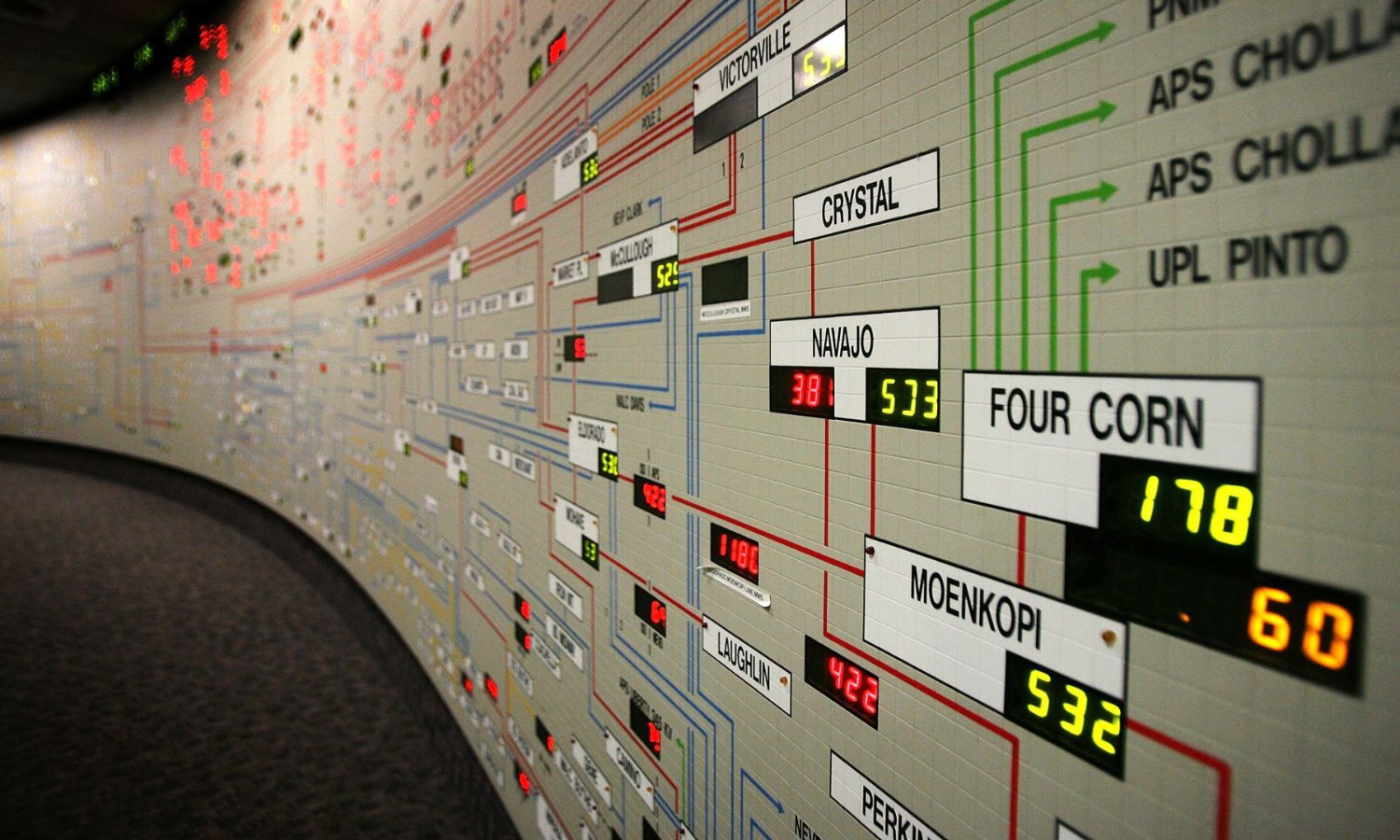

To connect to the transmission grid, power-generating projects must submit a request to connect to California’s grid operator (CAISO). CAISO then runs a series of studies assessing the impact the project will have on the grid. These studies ensure the project can safely move forward, or they may reveal certain infrastructure upgrades to transmission lines or substations that are needed for the new project to integrate into the grid. If the project continues along the interconnection process, an interconnection agreement will eventually be signed with CAISO.

Almost 1,000 projects with a combined capacity of over 500 GW are currently active in the CAISO’s interconnection queue, and this large queue is contributing to delays in getting clean energy projects online. Getting through the interconnection process is often cited by developers as one of the top barriers to project development.

In 2021, over 100 GW of clean energy projects submitted interconnection requests to CAISO. For perspective, CAISO’s record electricity demand peak was 52 GW in September 2022. While a big queue may seem like a good thing, it’s actually a big part of the problem. Interconnection studies are dependent on everything else in the queue as well, so too many interconnection requests have slowed down CAISO’s ability to accurately perform the studies in a timely manner. As developers are unsure which projects will be feasible with the grid, there are also many speculative projects in the queue that eventually get withdrawn. This adds more uncertainty and requires more time and resources from CAISO to re-run studies.

An informal CAISO survey revealed the high number of interconnection requests would likely continue in 2022, so the grid operator postponed the round of interconnection requests. After receiving another record-breaking number of interconnection requests in 2023 (354 GW!), CAISO has now requested to cancel the 2024 interconnection request window to work through the existing backlog and implement process reforms.

To be clear, most grid operators are experiencing similar backlogs in their interconnection queue. Compared to 2014, the number of annual interconnection requests nationally in 2023 was 7-fold higher with over 2,600 GW of generating capacity and storage now in interconnection queues across the country. PJM, the grid operator in the mid-Atlantic, similarly paused the intake of new interconnection requests as it works through its backlog.

What are California leaders doing about the backlog?

The good news is that CAISO is in the process of interconnection process reforms: It is currently finishing up its annual Interconnection Process Enhancement (IPE) initiative that will push through some major changes. The policy initiative introduces mechanisms to limit the queue intake and move projects through the queue faster to make the interconnection process more sustainable long-term. At a high level, the reforms prioritize projects for the interconnection process based on how projects align with available transmission capacity, interest from electricity buyers, project viability, and system needs.

CAISO, which also leads the transmission planning process, will additionally provide more data as to where current and future capacity will be available. Improving this data transparency will help developers site projects and reduce speculative interconnection requests.

As most of the nation’s grid operators are experiencing interconnection delays, reforms are also happening at the federal level. In 2023, the Federal Energy Regulatory Commission (FERC) issued reforms for all grid operators through FERC Order 2023. Similar to CAISO’s initiative, these are intended to reduce queue intake to more likely projects and speed up the interconnection review process.

In some ways, CAISO is further along than other grid operators in its efforts to make the interconnection process more efficient. For example, one of these FERC mandatory reforms is switching to cluster studies, rather than sequential studies, in the interconnection process. This is something that CAISO implemented in 2008.

However, other areas of the FERC reforms, such as incorporating alternative transmission technologies to improve transmission capacity, are still novel to CAISO. These initiatives are being addressed in the IPE and supplemented by state legislative efforts in compliance with FERC.

What California could do next

To work through the interconnection requests accompanying the clean energy transition, CAISO will need to increase staff capacity. The influx of interconnection applications has stretched CAISO staff beyond their ability to keep up with these reviews. CAISO has noted that the volume of interconnection requests is “unprecedented and unstainable.” A Department of Energy report notes that competition for workers with interconnection technical expertise, alongside burnout, have made it difficult to retain staff. More resources should go into improving workforce pipelines and educational opportunities for technical expertise. CAISO will need to focus on hiring and retaining experienced staff as the state accelerates its clean energy transition.

Second, equity considerations are still lacking in the proposed interconnection process, which may make it more difficult for projects owned by or serving Tribal communities and disadvantaged communities to connect to the grid. Part of the reforms are a scoring criteria rubric to help indicate which projects are considered the “most ready” by current industry metrics. However, this type of scoring and ranking could exclude projects that have alternative ownership or financial structures, which may be necessary or wanted for projects owned or serving marginalized groups.

For example, FERC recently granted a waiver to SAGE Development Authority, a Tribal community-owned wind project in North Dakota, allowing for more time to meet financial requirements given the project’s unique financing structure that relies on multiple contributors and philanthropic organizations.

CAISO’s interconnection process should provide a more systematic track that would allow projects like these to move through the interconnection process. Community stakeholders such as the Morongo Tribe, a Native tribe in California that is also a transmission owner, showcase the potential for advancing equitable clean energy. Creating space for Tribal and disadvantaged community stakeholders to help design alternative interconnection tracks will ensure these projects come online, and that these communities are able to access the benefits of clean energy.

The roadblocks to clean energy in California must be cleared fast

The urgent need to bring more clean energy resources online has created growing pains for the outdated power grid. It won’t be an easy task, but reforming the interconnection process will be critical for California to achieve its clean energy goals. Moving forward, California must put in the effort and resources to work through the barriers in the clean energy development process. Legislators and regulators can fund and incentivize the necessary reforms to systematically get clean energy projects online faster. If California can work through these issues, it will once again show the state’s leadership and commitment to the clean energy future.

This is part 2 of 3 posts on the roadblocks and bottlenecks California is facing in its transition to 100% clean energy. Read Part 1 about transmission needs and Part 3 about permitting challenges.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://blog.ucsusa.org/vivian-yang/want-to-connect-clean-energy-to-californias-power-grid-get-in-line-part-2-of-3/