Worldwide, buildings are responsible for 37% of global carbon emissions and 34% of energy demand. This significant contribution to greenhouse gas emissions highlights the urgent need for action within the commercial real estate sector.

A modern building seen from below, surrounded by trees. AI generated picture.

A modern building seen from below, surrounded by trees. AI generated picture.

According to the Carbon Risk Real Estate Monitor and the Global Real Estate Sustainability Benchmark, only 15% of global buildings currently align with the Paris Agreement’s goals. This means 37% of global buildings must be decarbonised by 2030. Decarbonising commercial real estate is not only vital for reducing carbon emissions but also crucial for conserving nature. The environmental impact of buildings extends beyond carbon emissions to include resource depletion, pollution, and biodiversity loss. By transitioning to sustainable practices, we can mitigate these effects and contribute to a healthier planet.

This blog will guide you through the essentials of making commercial real estate carbon neutral, including understanding carbon footprinting in commercial real estate, compensating for your carbon balance, innovative strategies to become carbon neutral, policy and regulatory impact, economic benefits of carbon-neutral commercial real estate, and the future of commercial real estate in a carbon-neutral world.

Understanding carbon footprinting in commercial real estate

The carbon footprint of a commercial building refers to the total amount of greenhouse gases (GHGs) emitted directly and indirectly by the building throughout its lifecycle. This includes emissions from the energy used for heating, cooling, lighting, and operating the building, as well as emissions associated with the production and transportation of construction materials and the disposal of waste.

Read more: How do carbon footprints work?

Measuring the carbon footprint of a building provides a comprehensive view of its environmental impact, helping stakeholders identify key areas for improvement and develop strategies to reduce emissions.

Learn how to measure your carbon footprint

Energy consumption is one of the most significant contributors to the carbon footprint of commercial buildings. This includes the electricity and fuel used for lighting, heating, ventilation, and air conditioning (HVAC) systems, as well as power for office equipment and appliances. Inefficient energy use not only increases operating costs but also leads to higher emissions, making energy efficiency a critical area for decarbonisation efforts.

Construction materials are another major factor in the carbon footprint of commercial real estate. The production and transportation of materials such as concrete, steel, and glass are highly energy-intensive processes that result in substantial carbon emissions. Selecting sustainable materials and adopting green building practices can significantly reduce the environmental impact associated with construction.

Read more: Unveiling hidden carbon footprints: overlooked emissions sources in business operations

Operations and maintenance also play a crucial role in the overall carbon footprint of commercial buildings. Regular maintenance and upgrades of building systems can improve energy efficiency and extend the lifespan of equipment, reducing the need for frequent replacements. Additionally, adopting sustainable practices in daily operations, such as waste management and water conservation, can further minimise the environmental impact of commercial real estate.

Close-up of a man throwing a glass bottle into an appropriate container. AI generated picture.

Close-up of a man throwing a glass bottle into an appropriate container. AI generated picture.

Innovative strategies towards becoming carbon neutral

Various innovative strategies can be used to make commercial real estate carbon neutral. These include improving energy efficiency, implementing renewable energy, adopting sustainable practices, efficiently managing waste, and compensating for remaining carbon emissions.

Read more: How to reduce your business’ travel emissions through nature

One of the most impactful strategies for decarbonising commercial real estate is enhancing energy efficiency. Retrofitting existing buildings with energy-efficient technologies can significantly reduce energy consumption and emissions. This might include upgrading HVAC systems, installing energy-efficient lighting, and improving insulation. Additionally, integrating smart building systems and the Internet of Things (IoT) can optimise energy management by providing real-time data on energy use. These systems can automatically adjust lighting, heating, and cooling based on occupancy and usage patterns, ensuring that energy is used efficiently and waste is minimised.

Read more: Green infrastructure: how nature can improve urban living

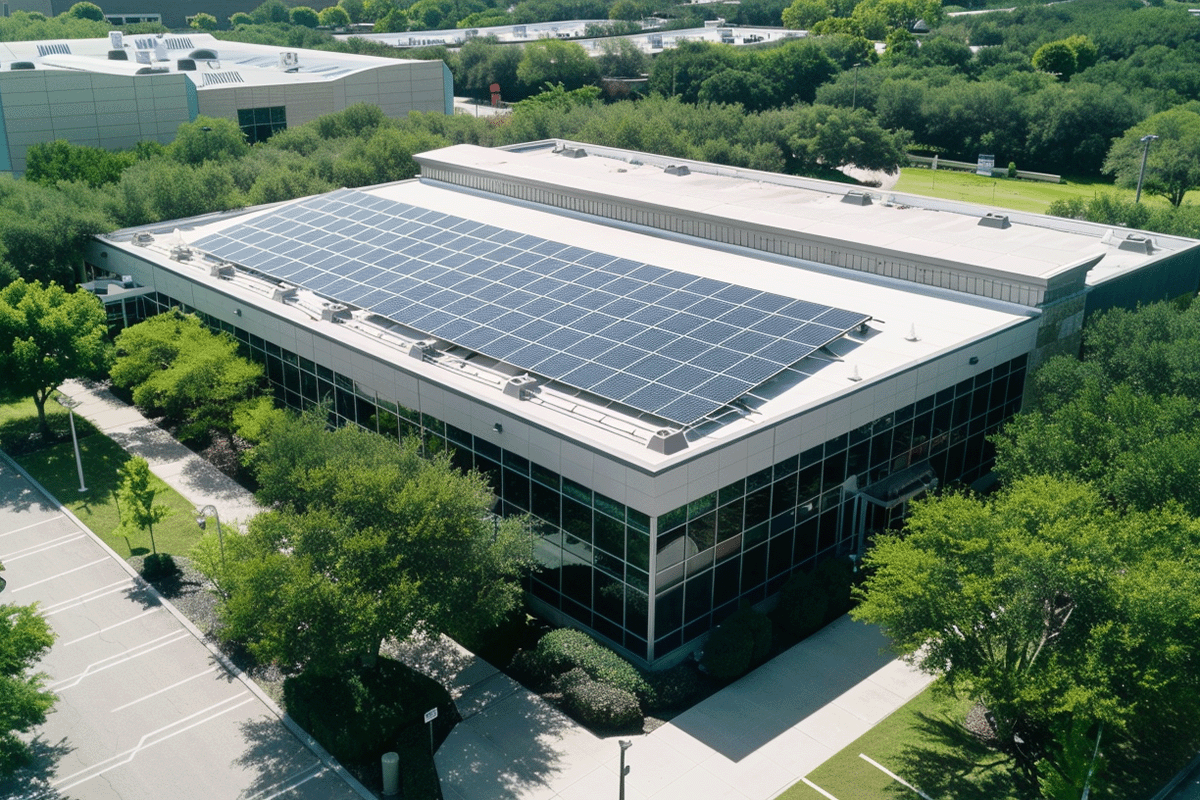

Transitioning to renewable energy sources is another crucial strategy for decarbonisation. Installing solar panels and wind turbines can help commercial buildings generate their own clean energy, reducing reliance on fossil fuels. Solar panels, in particular, are becoming increasingly cost-effective and can be installed on rooftops or integrated into building facades. Wind turbines, though less commonly used in urban settings, can be effective in areas with consistent wind patterns. By generating renewable energy on-site, buildings can lower their carbon footprint and contribute to a more sustainable energy grid.

Corporate building with solar panels on a roof. AI generated picture.

Corporate building with solar panels on a roof. AI generated picture.

Adopting sustainable construction practices is essential for reducing the environmental impact of new buildings and renovations. Using sustainable materials such as recycled steel and green concrete can lower the carbon emissions associated with construction. These materials not only reduce waste but also often have lower embodied carbon compared to traditional materials. Additionally, adhering to green building certifications and standards, such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method), ensures that buildings are designed, constructed, and operated with sustainability in mind. These certifications provide a framework for achieving energy efficiency, water conservation, and improved indoor environmental quality.

Read more: 10 Simple ways for businesses to save water

Effective waste management is another critical component of decarbonisation in commercial real estate. Reducing construction and operational waste can significantly lower a building’s environmental impact. This can be achieved by implementing recycling programmes, reusing materials, and reducing the amount of waste generated during construction and renovation projects. Additionally, adopting circular economy principles in building design and operations can further enhance sustainability. This approach involves designing buildings for durability, adaptability, and disassembly, allowing materials to be reused or recycled at the end of their life cycle. By minimising waste and maximising resource efficiency, buildings can contribute to a more sustainable and circular economy.

Read more: Reduce, reuse, recycle: 7 ways for businesses to reduce waste

Offsetting your carbon balance

Understanding carbon compensation

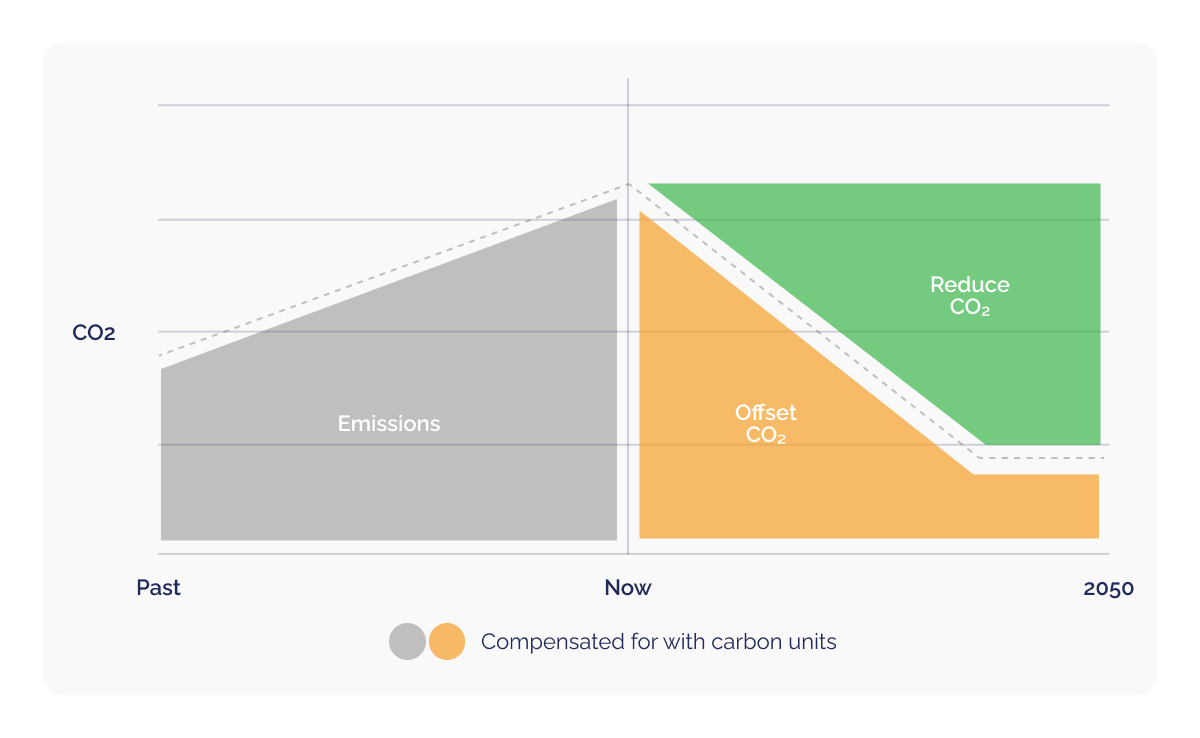

While companies can take numerous steps to reduce their carbon footprint, certain emissions are often unavoidable due to the nature of their operations. Past emissions can also not be reduced as they have already been emitted and carbon reduction can take time. This is where carbon compensation comes into play. Carbon compensation involves compensating for past and irreducible emissions with carbon units (also known as carbon credits) that are generated by carbon projects.

CO2 Reduce and Offset chart.

CO2 Reduce and Offset chart.

By purchasing carbon units, businesses invest in environmental projects that mitigate the impact of these residual emissions. For example, a company might invest in a reforestation project that plants enough trees to absorb the carbon equivalent to their unavoidable emissions. Alternatively, they might fund an energy-efficient cookstove project that prevents CO2 emissions from being emitted. This process of balancing unavoidable emissions with carbon units allows companies to pursue carbon-neutral goals and move towards net-zero emissions. Essentially, for every tonne of CO2 that a company emits, an equivalent amount is either absorbed or prevented from being released elsewhere, thereby balancing the overall carbon footprint.

Read more: The importance of carbon offsetting in achieving net zero

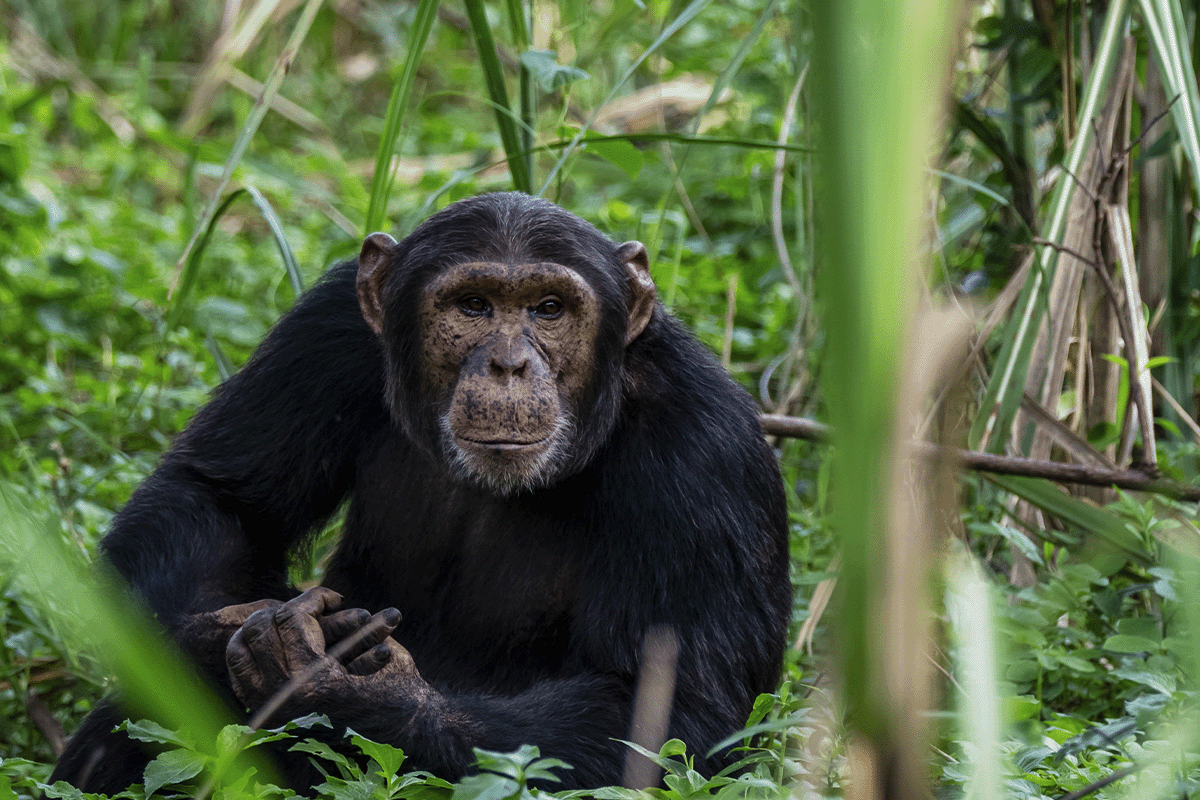

Carbon projects, such as DGB Group’s nature-based solutions, also offer many benefits in addition to carbon mitigation. From an environmental aspect, our projects restore degraded lands, ecosystems, and vital habitats. They help to revitalise biodiversity on a large scale. From a community aspect, our projects empower communities with job opportunities, training, educational programmes, infrastructure development, and improved health through reduced indoor air pollution.

Learn more about DGB’s impactful carbon units

Tree seedlings in a nursery. Hongera Reforestation Project, DGB.

Tree seedlings in a nursery. Hongera Reforestation Project, DGB.

How to use carbon units

Integrating carbon units into a carbon-neutral strategy involves identifying emissions that cannot be eliminated through direct reduction efforts and then using carbon units to compensate for these remaining emissions. This approach should be part of a comprehensive sustainability plan that prioritises both carbon reduction and compensation.

Read more: Sustainability simplified: Carbon footprinting for beginners

Companies should first conduct a thorough analysis of their carbon footprint, identifying all sources of emissions. Then, they can identify reduction measures and compensate for remaining and past emissions with high-quality carbon units. This integration ensures that companies are not merely compensating for their real-estate emissions but are also committed to reducing their overall environmental impact.

Measure your carbon footprint with DGB

A robust carbon-neutral strategy includes clear plans for purchasing carbon units over different time horizons. In the short term, companies can focus on immediate unit purchases to balance current and past emissions. Medium-term plans might involve investing in offset projects that will deliver benefits over the next few years, such as reforestation projects that take time to grow but offer significant long-term carbon sequestration and environmental benefits. Long-term plans should look at sustaining these efforts over decades, ensuring ongoing investment in projects that provide lasting environmental benefits.

By developing these phased plans, companies can maintain steady progress towards their net-zero goals and adapt their strategies as better technologies and opportunities become available.

Transparency and accountability are crucial when using carbon units. Choose projects with strong management, robust verification, and contingency plans to ensure durability. Select projects certified by reputable organisations like Verra or the Gold Standard to verify real and permanent offsets. Transparent projects provide clear information on calculations, fund usage, and impact.

Read more: Trading carbon, trading up: the public companies transforming sustainability

Companies need to partner with developers who regularly monitor the performance of their carbon projects to ensure they are delivering the promised carbon reductions. This involves implementing stringent due diligence processes and investing in projects that are independently verified, ensuring their impact and sustainability.

Bulindi chimpanzee in its natural habitat in Uganda. Bulindi Chimpanzee Habitat Restoration Project, DGB.

Bulindi chimpanzee in its natural habitat in Uganda. Bulindi Chimpanzee Habitat Restoration Project, DGB.

Companies also need to accurately report on their progress and efforts. Transparent reporting, such as reporting in line with the new Corporate Sustainability Reporting Directive (CSRD), builds trust with stakeholders, including customers, investors, and regulatory bodies. By maintaining a clear record of your carbon footprint and emissions compensated for, you can demonstrate your commitment to genuine carbon mitigation and continuous improvement in your carbon-neutral efforts.

Read more: 100 Reasons carbon credits are the best thing that ever happened to improve conditions on our planet

As demand grows for quality carbon units, costs will also rise, making these investments both financially and environmentally strategic. Early participants in the carbon market can therefore benefit from cost savings by purchasing carbon units now, securing long-term contracts, or investing in future projects to meet needs without financial strain.

Discover DGB’s nature-based projects

Policy and regulatory impact

Current regulations and policies worldwide are increasingly focused on promoting decarbonisation in the commercial real estate sector. Governments are implementing stricter building codes and energy performance standards to ensure that new and existing buildings meet higher energy efficiency criteria. For example, regulations such as the European Union’s Energy Performance of Buildings Directive (EPBD) mandate energy performance certifications and set targets for zero-energy buildings. In the United States, local laws like New York City’s Local Law 97 require large buildings to meet stringent greenhouse gas emission limits. These regulations are designed to reduce energy consumption and carbon emissions, driving the adoption of sustainable building practices.

Looking ahead, future policy trends are likely to further intensify the focus on decarbonisation within the commercial real estate sector. Governments are expected to introduce more ambitious climate targets and stricter regulations to align with international agreements such as the Paris Agreement. This may include mandatory reporting of greenhouse gas emissions in line with the CSRD, carbon pricing mechanisms, and increased requirements for energy efficiency and renewable energy use.

Read more: What is CSRD and how does it affect your business?

Additionally, policies promoting circular economy principles and sustainable construction materials are anticipated to gain traction. These evolving policies will have a profound impact on the industry, driving innovation and transformation as building owners and developers strive to meet new regulatory standards and contribute to global sustainability goals. The increasing regulatory pressure will also create opportunities for companies that lead in sustainability, enhancing their competitiveness and reputation in the market.

Economic benefits of carbon-neutral commercial real estate

Investing in energy efficiency and renewable energy technologies can lead to substantial long-term cost savings for commercial real estate owners. Retrofitting buildings with energy-efficient systems, such as advanced HVAC, LED lighting, and smart building management systems, reduces energy consumption and lowers utility bills. Additionally, generating on-site renewable energy through solar panels or wind turbines can significantly cut energy costs over time. Addressing and compensating for your carbon footprint also offers many benefits. It boosts your brand, attracts investment, improves reporting, positions you as a preferred partner, and ultimately saves costs and fosters growth.

Read more: The power of sustainability: Why investing in sustainability drives faster company growth

Buildings that incorporate sustainable practices and technologies tend to have higher property values and greater marketability. Green buildings are often more attractive to buyers, investors, and tenants who recognise long-term financial and environmental benefits, commanding higher rents and sale prices. Eco-conscious tenants are increasingly prioritising buildings with green certifications and sustainable features. These tenants are often willing to pay a premium for properties that support their environmental goals and contribute to their corporate social responsibility initiatives. Certifications such as LEED and BREEAM serve as benchmarks of sustainability, enhancing the reputation and desirability of a property.

A garden on a building’s rooftop. AI generated picture.

A garden on a building’s rooftop. AI generated picture.

Similarly, investors are placing greater emphasis on Environmental, Social, and Governance (ESG) criteria when making investment decisions. Properties that demonstrate strong sustainability performance are more likely to attract investment from funds and organisations committed to ESG principles. By decarbonising their real estate portfolios, property owners can appeal to this growing segment of tenants and investors, enhancing occupancy rates and investment opportunities.

While these initial investments may be substantial, the reduced operational expenses, potential tax incentives and rebates, and many other benefits often result in a favourable return on investment. These savings can then be reinvested into further sustainability initiatives, creating a positive feedback loop of cost reduction and environmental benefits. As sustainability becomes a more significant factor in property valuations, owners who invest in making their real estate assets carbon neutral are likely to see enhanced financial returns and competitive advantages in the marketplace.

The future of commercial real estate in a carbon-neutral world

Over the next decade, the commercial real estate sector is expected to undergo significant transformations driven by the urgent need to address environmental degradation. One major prediction is the widespread adoption of net-zero energy buildings, which produce as much energy as they consume through a combination of energy efficiency measures and on-site renewable energy generation. Governments and regulatory bodies will likely implement more stringent carbon reduction targets, pushing the industry to innovate, adopt sustainable practices, and invest in carbon units. Additionally, there will be a greater emphasis on transparency and accountability, with companies required to report on their sustainability performance and progress toward net-zero goals.

Read more: Era of revolution: groundbreaking carbon market development

Innovation will be a critical driver in the decarbonisation of commercial real estate. Advances in building technologies, such as smart sensors, artificial intelligence, and the IoT, will enable more efficient energy management and resource use. Innovative construction materials, like carbon-absorbing concrete and recycled composites, will reduce the environmental impact of new buildings. Continuous improvement in renewable energy technologies, including solar panels and wind turbines, will make them more accessible and cost-effective for commercial properties. Furthermore, innovative financing models, such as green bonds, will facilitate investment in sustainability initiatives.

Read more: Industry carbon footprints: transport, events, and celebrities

Building a culture of sustainability within the commercial real estate industry is essential for achieving long-term carbon reduction goals. This involves fostering an environment where sustainability is prioritised at all levels, from top executives to operational staff. Companies can encourage this culture by providing sustainability training and education, setting clear sustainability targets, and recognising and rewarding achievements in sustainability.

Aerial view of a forest on the outskirts of a city. AI generated picture.

Aerial view of a forest on the outskirts of a city. AI generated picture.

Collaboration within the industry is also crucial, with companies sharing best practices and working together on sustainability initiatives. Engaging tenants and other stakeholders in sustainability efforts can further enhance the impact, as everyone plays a role in reducing the overall carbon footprint. By embedding sustainability into the core values and operations of the industry, commercial real estate can make significant strides towards a carbon-neutral future.

The first step in your sustainability journey with DGB Group

Carbon-neutral commercial real estate is crucial for supporting nature, reducing carbon emissions, and preserving natural resources. The sector is responsible for a significant portion of global carbon emissions, and transitioning to sustainable practices is essential for achieving environmental targets and ensuring a healthier planet for future generations. Implementing energy-efficient technologies, adopting renewable energy sources, improving waste management practices, and compensating for residual emissions are just a few steps that can make a substantial impact.

Close-up of a DBG member planting tree seedling. Hongera Reforestation Project, DGB.

Close-up of a DBG member planting tree seedling. Hongera Reforestation Project, DGB.

As we move towards a more sustainable future, it is imperative for all stakeholders in the commercial real estate industry to take proactive steps in their net-zero journey. DGB Group stands out as a leader in providing credible, transparent, and impactful carbon unit opportunities. Purchasing our high-quality carbon units can complement your carbon-neutral efforts. All our projects are independently verified by leading standards, such as Verra and the Gold Standard, ensuring their quality and integrity. Our projects are not just about carbon reduction and removal; they offer a multitude of co-benefits, making your efforts truly impactful. With DGB’s verified carbon units, businesses can ensure that their contributions are effective in supporting biodiversity, restoring ecosystems, and empowering local communities.

Contact us to start your sustainability journey

The collective efforts of the commercial real estate industry can drive significant progress towards a low-carbon economy. By aligning with forward-thinking financial strategies that prioritise planetary benefits, companies can enhance their corporate image, meet regulatory requirements, and contribute to global environmental efforts. By partnering with DGB, you can position your businesses at the forefront of the transition to a low-carbon economy. Together, we can significantly contribute to global environmental efforts and benefit from the long-term advantages of a sustainable, low-carbon economy.

Take the first step: achieve your goals with DGB’s carbon units

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.green.earth/blog/the-carbon-neutral-future-of-commercial-real-estate