- Sweden’s Vattanfall Taps Two Finalists for SMR New Build

- Finland Ready to Consider New Nuclear Reactors Including SMRs

- Estonia’s Parliament Adopts Nuclear Energy Legislation Favorable to SMRs

- France Announces Plans to Build Eight More New Nuclear Reactors

- National U.S. Survey Shows Record High Support for Nuclear Energy

Sweden’s Vattanfall Taps Two Finalists for SMR New Build

Sweden’s State-owned electric power utility Vattanfall has shortlisted two developers of light water design small modular reactors. GE-Hitachi, the developer of a 300 MW BWR type SMR and Rolls-Royce, the developer of a mid- range 470 MW PWR, are the two firms tapped for a round of best and final proposals.

Sweden’s State-owned electric power utility Vattanfall has shortlisted two developers of light water design small modular reactors. GE-Hitachi, the developer of a 300 MW BWR type SMR and Rolls-Royce, the developer of a mid- range 470 MW PWR, are the two firms tapped for a round of best and final proposals.

In addition to the choices for SMRs, the utility said that it is considering proposals for new full size reactors. The proposals are from Westinghouse (1150 MW AP1000), EDF (1650 MW EPR) , and KHNP( 1400 MMW APR1400).

The utility did not provide a timeframe for selection of an SMR vendor nor for the full size reactors.

Insofar as the SMRs are concerned, the next phase reportedly will be a comprehensive analysis of the proposals from the two shortlisted SMR suppliers.

Vattenfall said it plans to establish a timeline for potentially deploying SMRs to facilitate new nuclear power generation on the Värö Peninsula. Vattenfall has previously said the area can accommodate three to five SMR reactors.

Vattenfall reiterated its ambition to have a first reactor, regardless of type, in operation at Ringhals “in the first half of the 2030s at the earliest.” (Map: Wikimedia – Open Street Maps)

Vattenfall reiterated its ambition to have a first reactor, regardless of type, in operation at Ringhals “in the first half of the 2030s at the earliest.” (Map: Wikimedia – Open Street Maps)

Sweden has blown hot and cold about the use of nuclear energy in a country that relies on hydro and wind power that account for 35% of its electricity.

Biofuels are a major source of heat along with oil and gas. According to the World Nuclear Association’s profile of nuclear energy in Sweden, the government has swung back and forth like a trick yo yo between phasing out nuclear energy to promoting it as a key element of its climate change policy.

- Sweden’s six nuclear power reactors, all BWRs, provide 6.94 GW or about 40% of its electricity

- In 1980, the government decided to phase out nuclear power. In June 2010, Parliament voted to repeal this policy.

- The country’s 1997 energy policy allowed 10 reactors to operate longer than envisaged by the 1980 phase-out policy, but also resulted in the premature closure of a two-unit plant (1200 MWe). Some 1600 MWe was subsequently added in uprates to the remaining ten reactors.

- In 2015 decisions were made to close four older reactors by 2020, removing 2.8 GWe net.

- In June 2023 Sweden replaced its energy target of ‘100% renewable’ electricity by 2040 with ‘100% fossil-free’ electricity allowing the government to push forward with plans for new nuclear plants.

- In November 2023 the government announced plans to construct two large-scale reactors by 2035 and the equivalent of 10 new reactors, including small modular reactors, by 2045.

Vattenfall nuclear power head Desirée Comstedt said in a statement to the Swedish news media, “Shortlisting two potential suppliers of small modular reactors is one of several steps in our continued work towards new nuclear power on the Värö Peninsula at Ringhals.”

“We haven’t made a choice of reactor technology yet. Regardless of whether we choose small modular reactors (SMRs) or large-scale reactors, a future investment decision will, among other things, require a reasonable risk-sharing model with the state. This is necessary to lower financing costs and thereby enable a reasonable cost for electricity production that customers are prepared to pay.”

Vattenfall reiterated its ambition to have a first reactor, regardless of type, in operation at Ringhals “in the first half of the 2030s at the earliest”.

& & &

Finland Ready to Consider New Nuclear Reactors

Finland is ready to consider financial support for new nuclear production, the country’s environment and climate minister said addressing industry concerns over profitability due to low power prices spurred by renewables buildout. (Image: NEA (2020), Olkiluoto Nuclear Power Plant – Finland, OECD Publishing, Paris)

Finland is ready to consider financial support for new nuclear production, the country’s environment and climate minister said addressing industry concerns over profitability due to low power prices spurred by renewables buildout. (Image: NEA (2020), Olkiluoto Nuclear Power Plant – Finland, OECD Publishing, Paris)

“The government is ready to consider financial incentives for clean baseload and specifically also for new nuclear production,” Kai Mykkanen, responsible for energy matters, told Montel’s Finnish Energy Day in Helsinki, adding that the incentives would focus on easing financial risks.

Nuclear developers are mulling new capacity but have said they have concerns over profitability due to low wholesale power prices in the region. They asked for government support either in terms of rate guarantees or direct subsidies.

Mykkanen said that while the market was typically better equipped to deal with financial risks than the government, the large scale of nuclear investments, coupled with uncertainties about future prices, requires government intervention.

Finland currently operates five nuclear reactors with a total capacity of 4.4 GW. The government is reviewing nuclear energy legislation to facilitate the construction of small modular reactors (SMRs) and has plans to present the new legislation to parliament in 2026.

“The aim is to create one of the most lucrative environments… when it comes to regulatory consistency and stability,” Mykkanen said.

Finland’s efforts to build a sixth reactor, Fennovoima Hanhikivi 1 which was to be a Russian supplied 1200 MW VVER, was cancelled due to Russia’s invasion of Ukraine and European sanctions placed on Russia as a result. The World Nuclear Association profile of Finland’s nuclear power sector indicates the Russian invasion of Ukraine, and the countermeasures by EU and western countries as a consequence, were seen as “posing a major risk for the Hanhikivi 1 project.”

Prior to that decision progress on the planned Russian built reactor was delayed by regulatory issues and a bizarre case involving a representation by Rosatom of a Cyprus based firm presented as an external investor to the project which actually was a Russian shell company. The country’s Ministry for Economic Affairs said that it would not grant a construction permit under the current circumstances.

Finland’s plans for a seventh nuclear reactor, Olkiluoto 4, were cancelled due to extensive schedule delays and enormous cost overruns for EDF’s construction of Olkiluoto 3.

& & &

Estonia’s Parliament Adopts Nuclear Energy Legislation Favorable to SMRs

(WNN and NucNet contributed to this report) Estonia’s parliament, the Riigikogu, has passed a resolution supporting the adoption of nuclear energy in the country, paving the way for the creation of the legal and regulatory frameworks needed to build nuclear reactors in Estonia. The parliament based its decision on 2024 IAEA analysis conducted by the Nuclear Energy Working Group, which concluded that the adoption of nuclear energy in Estonia was feasible.

According to the report, Estonia’s energy mix is roughly 63% coal, 6% natural gas, and 25% other fuels including those extracted and refined from the country’s oil shale deposits. Estonia’s climate strategy includes plans for up to four small modular reactors with the first to be operational around 2035.

According to a the IAEA report on Estonia’s efforts to develop nuclear power, Estonia is seeking to reach net zero emissions by 2050 and bolster its energy security. The country is looking at nuclear power as a reliable and low carbon option to diversify its energy mix by 2035 when the country plans its phase-out of domestic oil shale.

The plans for nuclear energy are focused on small modular reactors (SMRs), which are attracting growing global interest due to their ability to meet the need for flexible and affordable power generation for a wider range of users.

The new legislation says that Estonia’s national development plan up to 2035 must consider the impacts of adopting nuclear energy in order to ensure security of energy supply “during the transition to climate-neutral energy production.”

This will include the development of a draft act on nuclear energy and safety as well as the creation of a regulatory authority for nuclear energy.

The explanatory memorandum that accompanies the legislative resolution says adoption of nuclear energy in Estonia would, among other things, provide a continuous generation capacity that would balance the fluctuations in renewable energy generation capacity, help Estonia reach its climate neutrality target, ensure a stable and affordable electricity price in the long term perspective, promote research and development, bring economic benefits and create jobs for local people.

Forty-one members of the Riigikogu voted in favor of the draft resolution, with 25 voting against it and two members abstaining.

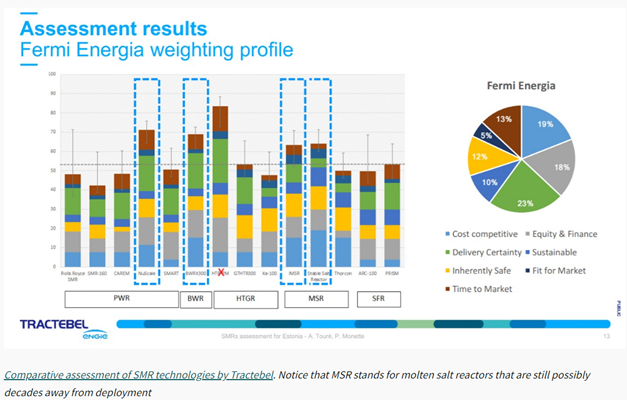

Firmi Energia SMR Technology Selection and Target Dates

In January 2024 Kalev Kallemets, CEO of Fermi Energia, a company set up in 2019 to promote SMR technology in Estonia, told Euractiv that his firm “is now targeting two 300 MWe units, for a total of 600 MWe of electricity production and remote heat production.”

The technology chosen is the BWRX-300 reactor developed by GE Hitachi. The first prototype of this model is expected to be built in Canada and has also been selected by PKN Orlen in Poland for part of its planned fleet of SMRs.

The choice of a light water design was driven by a 2020 study of several types of current and advanced reactors. It concluded that fourth generation designs are still too far into the future to be worth considering now. The only options that could reach a usable stage in the next decade are pressurized water reactors (PWR) and boiling water reactors (BWR)

Image: Comparative assessment of SMR technologies by Tractebel.

Regarding the selection of the site, a preliminary study completed in spring 2023 selected 16 regions in Estonia for construction.

For Fermi Energia, the decision of the Riigikogu also means that the firm can continue its work to secure legal and financial support to build SMRs.

CEO Kallemets said in a January 2024 statement to news media in Estonia, “As the next step, within four months Fermi Energia will submit an application for the initiation of a designated national spatial planning procedure, including for environmental impact assessments for two or three locations, during which the most suitable location for a plant with two BWRX-300 small reactors will be formally selected.”

Kallemets said the designated national spatial planning procedure is likely to last until 2028, by which time the construction of a reactor of the same type should be completed or underway in Darlington, Canada, and halfway through in Stawy Monowskie, Poland.

“On the basis of these projects and successful preliminary work, and a positive decision by the shareholders, we will be able to apply for a building permit in Estonia in 2029 at the earliest, which, with the help of the reference plants’ authorization processes and pre-construction experience, will allow us to start construction in 2030 or 2031 and have electricity production at the first reactor begin in 2035.”

However, in February 2024 the firm noted several caveats to the 2035 date. Estonia’s Fermi Energia’s chairman at that time Sandor Liive said that the country’s first SMR, which is in the process of approval by the Estonian government and parliament, might not be operational by 2035.

“This [approval and planning prior to the start of construction] all takes four years, maybe four and a half years, although it may be possible to save some time. A nuclear safety department must still be formed, national competencies further developed and additional planning permits are needed as well,.”

“Realistically this takes nine to 11 years, so we would be ready in 2035, unless something unexpected happens”.

Fermi Energia is a nuclear energy company founded in 2019 by Estonian nuclear energy experts and businesspeople, which plans to build a nuclear power plant with small modular reactors in Estonia to support the fulfillment of the country’s climate goals and ensure security of supply. Fermi Energia is a member of the European Industrial Alliance on SMRs.

& & &

France Announces Plans to Build Eight More New Nuclear Reactors

President Emmanuel Macron’s recent (06/12/24) announcement of the construction of eight new nuclear reactors is seen by the French news media as being a decisive step in France’s energy policy. This decision aims to accelerate the energy transition by reducing dependence on fossil fuels.

President Macron had already initiated an ambitious program in February 2022, before the start of the conflict in Ukraine, to extend the life of existing reactors and build six new EPR2-type reactors. These first reactors are planned to be operational by 2035-2037. The current announcement adds a further eight reactors to this plan for a total of 14 units with planned power ratings of 1650MW.

The French Minister of the Economy, Bruno Le Maire, recently underlined the enormous challenges that this project represents for the French nuclear industry. During a Senate inquiry, he recalled the ups and downs of the industry, which he says has lost critical skills and now needs to rebuild. He cautioned that the completion of the first six EPR2s will serve as a test of France’s ability to successfully complete another eight units. The success of a 14 unit program will depend on the industry’s ability to meet deadlines and costs.

EDF, the state-owned nuclear electric utility, has already received the go-ahead for preparatory work on the first two EPR2 plants at Penly (Seine-Maritime). Additional reactors are planned for Gravelines and the Bugey site. The locations of the eight new reactors have not yet been determined.

France currently has 56 nuclear reactors, all PWRs, supplying 61.4 GW of electric power. One new nuclear reactors, an EPR which will produce 1650 MW, is under construction at Flamanville.

& & &

National U.S. Survey Shows Record High Support for Nuclear Energy

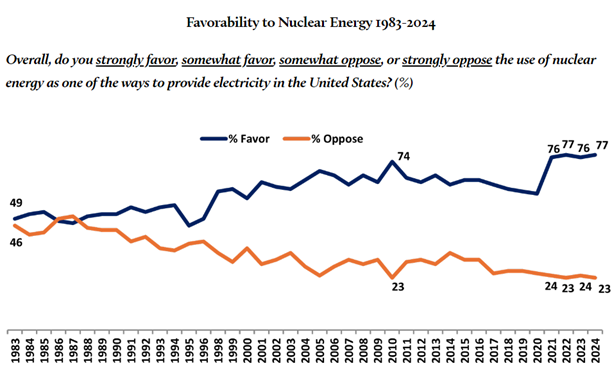

The 2024 National Nuclear Energy Public Opinion Survey shows that favorable public opinion of nuclear energy continues at a record high. For four years in a row, more than three-fourths of the U.S public said that they favored the use of nuclear energy. That is a sea change from four decades ago, when the public was about evenly divided between those who favored nuclear energy and those who were opposed.

Image: Bisconti Research, Inc

Support for License Renewal and Building More Plants Also at Record High

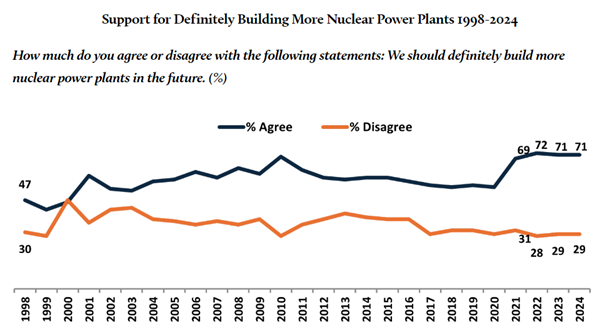

Opinions about license renewal and building more plants also are overwhelmingly favorable in 2024 and have stayed at the same record-high level for four years. When these questions were first asked, barely half the public supported more plants, but support for license renewal has been present all along.

The vast majority of the public (88 percent) agrees that we should renew the license of nuclear power plants that continue to meet federal safety standards. On this measure, the public has always viewed nuclear power plant license renewal as similar to renewing a driver’s license—if you can drive safely, the license should be renewed. More than 90 U.S. nuclear power plants received license renewal over the period of the trend line, with support of the local communities.

Support for building more nuclear power plants has grown, especially since 2021.

Image: Bisconti Research, Inc

The survey also found a large number of respondents, especially women, were “fence sitters” According to the survey results, a large majority of all demographic groups favors nuclear energy. Men college graduates stand out as most strongly favorable. Women, both college graduates and not college graduates, include a large number with middle opinions. In the case of men, there is a big difference between those with and without a bachelor’s degree—the latter being more uncertain. Gen Z and Gen X are the age groups with largest numbers in the middle.

# # #

Share this:

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://energycentral.com/c/ec/nordic-baltic-states-warm-nuclear-energy-and-smrs