Financing the new hydrogen economy is already a challenge. Financing hydrogen production in Emerging Markets and Developing Countries (EMDC) is an even bigger one, yet vitally important for supplying richer nations with hydrogen while creating new industries in the EMDC. This month, the World Bank Energy Sector Management Assistance Program (ESMAP) together with the Government of the Netherlands and Invest International organised a Financing Forum during the World Hydrogen summit in Rotterdam. The Forum brought together a diverse group of stakeholders, including project developers, development financing institutions, commercial banks, and investors. Carolina Lopez Rocha, Dolf Gielen and Chandrasekar Govindarajalu at the World Bank Group summarise the insights and conclusions of the discussions. They look at the risks and risk mitigation strategies essential for financing hydrogen projects. Governments, investors, banks and insurers all have a role to play, as do the wide range of tools available to them from incentives and subsidies through to concessionary financing. Some lessons can be learned from the European and H2Global auction schemes, but risks are much higher for EMDC. And unanswered questions still remain (e.g. will genuine demand going forward match hydrogen production ambitions), adding to the risks. It’s why the World Bank has created the “10 GW Lighthouse Initiative” to drive progress in renewable hydrogen project development in EMDC, say the authors.

Financing the new hydrogen economy is already a challenge. Financing hydrogen production in Emerging Markets and Developing Countries (EMDC) is an even bigger one, yet vitally important for supplying richer nations with hydrogen while creating new industries in the EMDC. This month, the World Bank Energy Sector Management Assistance Program (ESMAP) together with the Government of the Netherlands and Invest International organised a Financing Forum during the World Hydrogen summit in Rotterdam. The Forum brought together a diverse group of stakeholders, including project developers, development financing institutions, commercial banks, and investors. Carolina Lopez Rocha, Dolf Gielen and Chandrasekar Govindarajalu at the World Bank Group summarise the insights and conclusions of the discussions. They look at the risks and risk mitigation strategies essential for financing hydrogen projects. Governments, investors, banks and insurers all have a role to play, as do the wide range of tools available to them from incentives and subsidies through to concessionary financing. Some lessons can be learned from the European and H2Global auction schemes, but risks are much higher for EMDC. And unanswered questions still remain (e.g. will genuine demand going forward match hydrogen production ambitions), adding to the risks. It’s why the World Bank has created the “10 GW Lighthouse Initiative” to drive progress in renewable hydrogen project development in EMDC, say the authors.

The financing gap

World Bank, OECD, Hydrogen Council and Global Infrastructure Facility highlighted in their joint report Scaling Hydrogen Financing for Development a pressing issue: Emerging Markets and Developing Countries (EMDC) need approximately US$ 100 billion annually for hydrogen investments between now and 2030. Around half of that amount is for renewable power generation. Electrolysers, downstream processing and enabling infrastructure account for the remainder.

Despite the growing recognition of the clean hydrogen potential to help achieve Paris targets, the current investment levels are far below what is required. BNEF has calculated that out of total global energy transition investments of US$ 1,769 billion, clean hydrogen investments amounted to US$10.4 billion in 2023, primarily in USA, Europe and China. Inclusion of the renewable energy component for hydrogen production could triple this figure but it is still a small share of total energy transition investments and an order of magnitude below EMDC investment needs. Thus, investment volumes fall short.

Clean hydrogen can be categorised into two main types: low-carbon hydrogen and renewable hydrogen. Low-carbon hydrogen is produced from natural gas with carbon capture and storage (CCS), whereas renewable hydrogen is produced from water electrolysis using renewable power sources like wind or solar energy. It is expected that renewable hydrogen will account for the major share. However, despite its environmental benefits, renewable hydrogen remains more expensive to produce than conventional hydrogen. This cost disparity poses a significant challenge for its widespread adoption and underscores the need for innovative financing solutions.

The production costs are determined by the capital intensity of the projects and the cost of financing. Our rule-of-thumb is 1-10-20-30: a million tonne per year of renewable hydrogen production capacity requires 10 GW electrolysers capacity, 20 GW renewable power and US$ 30 billion of investments.

Developing quality projects takes time. This was discussed in the forum. For example, the selected bidders participating in the H2Global’s pilot tender asked for more time than originally anticipated to submit their final bids. The quality and maturity of today’s projects varies widely, and this impacts the speed at which renewable hydrogen can be rolled out.

The economic viability gap and the need for innovation

The production cost of renewable hydrogen is a critical factor in its economic viability. Currently, the production cost stands at around US$3 per kilogram in the very best locations, which is three times the cost of conventional hydrogen production in good locations.

Average cost are considerably higher, as witnessed by the recent European auction results with LCOH of 5.3 to 5.8 EUR/kg (6 US$/kg) in Greece, Sweden and Spain and 11 to 13.5 EUR/kg (12 US$/kg) in Austria, Belgium, Denmark, France, Germany and Poland. The competitiveness of renewable hydrogen varies widely by country and even by location and it is influenced by factors such as natural gas prices and the availability of subsidies.

Conventional hydrogen production costs are determined by the natural gas price. Whereas natural gas feedstock costs 2 USD/GJ in the USA, the price is 8-15 USD/GJ in Europe or Japan. The geographical spread of successful European offers in the recent Hydrogen Bank auction reflects the importance of renewable resource quality for the production cost.

Subsidies and tax breaks

Also, subsidies and tax breaks can impact the project economics and production cost of renewable hydrogen substantially. In the US up to 3 US$/kg tax breaks will be provided for renewable hydrogen production, though the specific rules that apply are still debated. Globally around US$ 350 billion in hydrogen subsidies have been announced, according to BNEF. These subsidies are dominated by OECD countries and China.

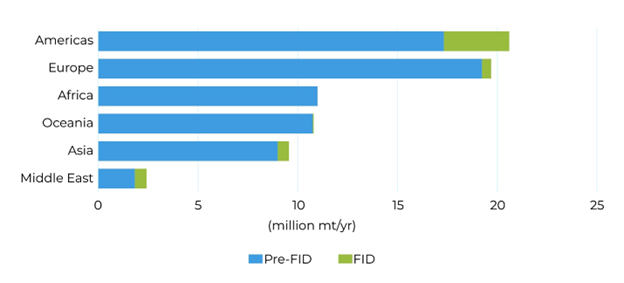

Other EMDC do not have the same budgetary space. It is therefore no surprise that EMDC projects with Final Investment Decision (FID) account for less than 1 Mt annual production (Figure 1). According to the Hydrogen Council and McKinsey, 234 projects are in preparation in EMDCs, with LAC leading, followed by MENA, China, Africa and India. The size and the project types vary widely.

Figure 1: Status of global hydrogen project announcements / SOURCE: S&P Global Commodity Insights

Policies and regulations

Policies and regulations can impact the project investment needs. For example, hourly matching of renewable power supply and electrolysers operation requires the deployment of a mix of renewables including more costly supply options and possibly investments in electricity storage, or it can impact the number of operating hours of the electrolysers. Spatial matching of renewable power generation and electrolysis may require investments into more costly supply options. For example, offshore wind is twice as expensive as onshore wind, and onshore wind in good locations is again twice as expensive as solar PV per kWh of electricity produced. Further amendments and clarifications to the rules and regulations could improve uptake.

Technology cost reduction

Technology cost reduction will be critical to reduce hydrogen production cost. Chinese alkaline electrolysers sell at 962-1113 USD/1000 m3 (around 200 US/kW), PEM at roughly three times that price. Comparable uninstalled US PEM price is currently US$ 1000/kW, twice as much for installed systems. In the current geopolitical climate such differences may give rise to protectionism as countries vie for manufacturing market share. However innovation is another way to close the cost cap and accelerate renewable hydrogen deployment. The US government plans to drive the cost of PEM electrolysers to a quarter of their current cost within two years, targeting an uninstalled capital cost of US$250/kW for PEM by 2026 and US$100/kW by 2029-2036.

Renewable power costs

Renewable power costs determine renewable hydrogen costs. The capital intensity of wind and solar in combination with increasing financing costs have increased Power Purchasing Agreement prices in recent years. Whereas wind has seen significant cost increases as basic materials such as steel have increased in price, the cost of solar PV panels has continued to fall. In quarter one of 2024, PPA prices in Europe declined again by 5%. Further cost reductions will be critical. Falling electrolyser cost may allow in the future a daytime only operation mode so low-cost solar PV can become the main energy source. Limited opportunities exist elsewhere to deploy low-cost surplus hydropower, for example in the case of Paraguay.

In conclusion a wait-and-see approach will not get us the hydrogen deployment that we need. We also need learning-by-doing, which requires active support for initial projects and upscaling. And we need continued innovation to drive down technology costs.

Project financing structure

Renewable hydrogen projects are very capital intensive and have limited operating costs (if the renewable power supply is included in the project scope). The high CAPEX results in large upfront financing needs. As a consequence, the cost of financing is a critical factor that has a large impact on the production cost. The following discussion will focus on this specific factor.

Two types of projects can be identified: those that are on the books of large companies (corporate financing) and those that deploy a special purpose vehicle (SPV). An SPV is a subsidiary created by a parent company to isolate financial risk. This structure is widely used for energy projects and is considered the preferred approach for hydrogen projects. SPV’s economic and financial viability depends on the revenue stream and the offtake contract is therefore critical. However, SPVs require higher returns due to the perceived risks including those associated with new technologies and the nascent hydrogen sector.

Any new technology is considered risky and therefore faces elevated cost of financing. This is reflected in the debt-equity ratio that tends to be lower for new technologies. Whereas a solar PV project may be financed with 90% debt and 10% equity, a hydrogen project may require a 60% debt and 40% equity ratio. Equity is considerably more expensive than debt because of the elevated risk in terms of variable returns and the potential loss of the invested funds in case of default. Yet a minimum share of equity is determined by the project capability to meet debt servicing requirements from the revenue stream. In a developing country context debt may be priced at 8-10% while equity is priced at twice the price at 15-20%. A much higher cost of debt can occur in case of economic or political instability: the yield on sovereign bonds – generally seen as a lower bound for the cost of debt – can rise to 50% in countries that face a financial crisis.

Derisking as a strategy to reduce the cost of financing

Risks can be split into country specific risks common to all large infrastructure projects in EMDC and unique hydrogen specific risks. A renewable hydrogen project is especially sensitive to country risk because of its capital intensity. Once a hydrogen project is established, it is very costly to walk away or stop operating. The sensitivity to country specific risk factors is thus high. Guarantees can be deployed to reduce country risks. This is a well-established practice in other sectors.

Most early hydrogen projects have some kind of government involvement. EMDC government loan default rates have mostly been in the range of 2-4%, indicating the risks of lending to emerging markets are low. Moreover, recovery rates for private lenders in case of default were 74.7% between 1994 and 2022.

Most of the residual risks beyond the overall country risk are policy derived. Governments can mitigate such risks, using concessional financing or budget resources, through offtake agreements, demand guarantees, regulatory policy guarantees etc. But the prevalence of such structures is rare. A key explanation is that the guarantee needed to leverage the private sector is expensive.

Several risks influence the cost of capital for clean hydrogen projects. These specific risks centre on engineering, procurement, and construction (EPC) overruns, offtake default, technology nonperformance, withdrawal of regulatory incentives, and exchange rates. Implementing cost-effective and efficient de-risking mechanisms could substantially decrease the weighted average cost of capital, making projects economically viable, which will accelerate their deployment and reduce the financing gap.

During the Finance Forum, commercial banks reported their participation in the syndicated loans for NEOM in Saudi Arabia an H2GreenSteel in Sweden, two large renewable hydrogen projects that have reached FID. The syndication spreads out risks allowing a large number of financing institutions to get comfortable with hydrogen projects. The World Bank and OECD have performed a robust market sounding among financiers and developers around the world to map the main risks hindering the financing for clean hydrogen projects in EMDCs. The results show the prevalence of six subcategories of risks. In order of priority: offtake risks stand out, followed by equally weighted political and regulatory risks; infrastructure risks; permitting risks; technology risks; and finally macroeconomic risks. The lower sub-categories of risks are: design, construction and completion risks; operational and maintenance risks; and supply risks. In today’s nascent clean hydrogen industry, the degree of a particular project’s risk largely depends on the actors involved. Evaluating the credit rating, experience, and credibility of project sponsors, engineering, procurement, and construction (EPC) contractors, primary technology providers, and offtakers must feature prominently in any risk assessment. As such, it is critical that EMDC governments select reputable partners.

How risks translate into cost of financing is not entirely clear. Data for individual projects and the risk calculation behind such projects are usually confidential and there is no uniform methodology to assess risk. Financial ratings of companies and countries provide some guidance but are not always available or directly applicable. More transparency regarding financing costs can help to drive costs down.

Risk mitigation mechanisms can help large-scale clean hydrogen projects in EMDC achieve financial viability. Policy de-risking mechanisms aim at removing the root causes of risks through policy measures. They include instruments to support institutional capacity building, local skills development, the implementation of relevant laws, and the management of infrastructure assets. Financial de-risking mechanisms deploy financial measures to avoid or reduce project risk.

Governments of EMDC can collaborate with development finance institutions to devise and implement a wide spectrum of financial de-risking instruments for clean hydrogen projects, tailored to the needs and characteristics of each country. Such instruments include partial credit guarantees, partial risk guarantees, political risk insurance, liquidity reserve accounts, and local currency support.

Export credit agencies have traditionally guaranteed investments abroad and have already played a role in first projects such as NEOM in Saudi Arabia. The Dutch government commented during the Finance Forum that there is an intent to change the Dutch Export Credit Agency (ECA, Atradius) rule so having Netherlands as a target market for exports will be sufficient for the Dutch ECA to cover non-OECD risks.

Also, insurers can provide technology performance insurances and have already done so for electrolysers. They can also insure against natural disasters.

Whereas such guarantees and insurances can help to reduce the financing needs, this is not a panacea. For example, a balance needs to be struck between financing cost reductions and the cost of the risk mitigation instruments. For example, MIGA political risk insurance and credit enhancement for cross-border private sector investors and lenders is particularly relevant for investments in countries with specific credit rating.

Finally, there is a need to consider proper risk allocation. Project partners and stakeholders may play a specific role, for example in terms of offtake risk guarantee, technology performance risk and EPC wrap.

Is the market willing to pay for renewable Hydrogen from EMDC?

A key insight from the Rotterdam World Hydrogen Summit was that demand falls short. The Hydrogen Council presented that implementation of today’s announced incentives will yield 3-7 Mt hydrogen demand while demand side policy targets add up to 27 Mt hydrogen demand. Private sector players commented during the Summit that the realisation of 20 Mt hydrogen demand in Europe seems unlikely. This puts the European 10 Mt import target into jeopardy. Given the preference for low-cost and low-carbon hydrogen in Korea and Japan – ideally from subsidised US production – this raises the question who will buy EMDC renewable hydrogen from projects that target exports.

Whereas focus is on the cost side, the revenue generated is also key for economic performance. This revenue stream depends on the offtake contract. The first European Hydrogen Bank auction has shown impressively that favorable offtake opportunities exist where even today less than 0.5 EUR/kg subsidies are needed for an economically viable project, with total production cost in the 5-6 Euro range. Some parties are thus willing to pay such an elevated price, which may help to get the market going. A recent announcement of an ‘ammonia for shipping’ project in Namibia illustrates the key importance of this demand sector for EMDC hydrogen development in the coming years.

H2Global has recently received 3.8 billion euros in additional funding from the German and Dutch governments and will soon launch the first results of its pilot auction. The European Hydrogen Bank relies on the member countries to shape and operationalise imports, using instruments such as H2Global.

In conclusion demand policies need to be strengthened in order to realise the desired hydrogen uptake and foster EMDC production.

The role of blended financing

One solution that is often touted is blended financing. This comes in four blending archetypes:

- concessional debt/equity,

- concessionally priced guarantees/insurance,

- project preparation or design-stage grant funding, and;

- technical assistance grant funding.

Concessional financing is anything below market rates. It is often viewed in Overseas Development Assistance (ODA) terms, although IBRD (World Bank financing), which is often labeled non-concessional, is also below market rates.

Yet the Independent Expert Group on Climate Finance concluded that the use of “blended finance,” deployed transaction-by-transaction in a bespoke fashion, has not proven scalable so far. Convergence reports that blended financing totals grew to US$15 billion in 2023, reaching a 5-year high. Commercial financing from DFIs/MDBs grew by 140% to US$4.9 billion in 2023. This is complemented with nearly US$1 billion in ODA, including funds channeled through DFI/MDBs. The use of concessional guarantees and risk insurance is on the rise — the dollar value of concessional guarantees accounted for 43% of all concessional funding in 2023. The energy sector accounts for nearly one third of deal activity and 47% of total blended capital flows. Much of this investment targets renewable energy development.

The OECD applies a broader blended financing definition and reports thus larger sums. According to the OECD, the two leveraging mechanisms (or archetypes) that mobilised the largest volumes of private capital were direct investment in companies and project finance special purpose vehicles (SPVs) (US$13.8 billion) and guarantees (US$9.8 billion). OECD estimated a total of US$61 billion of blended finance as of 2022.

The World Bank has calculated that private sector investments in infrastructure, or private participation in infrastructure (PPI) in EMDC amounted to US$86 billion in 2023. Energy projects represent a large chunk and energy saw a threefold increase in investment levels in 2023. A fifth of the funding came from DFIs (MBDs, bilateral development agencies, ECAs), and 13 percent from public sources.

According to the Independent Expert Group the non-sovereign arms of MDBs, even with the sweeteners of donor-funded concessional finance, only mobilised 64 cents in private finance per dollar of MDB plus concessional commitments. Historically the leverage ratio of transactions is higher (2.5-5.1) when there is market-rate participation from a DFI or MDB. It is therefore evident that DFIs and MDBs, with their limited asset bases, can only drive blended finance growth so much.

Concessional resources should be used only when they create the virtuous cycle, not to “compensate” for bad policies. Also the level of concessionality matters. For example, the World Bank Group follows a rigorous model to ensure minimal concessionality, reducing the likelihood of market distortions.

Official non-concessional finance is the engine for scaling up sustainable development investments in middle-income countries. MDBs are the backbone of the non-concessional official financing architecture, accounting for over 60 percent of the system (around US$100 billion per year). Bilateral agencies are also important but in aggregate account for only one quarter of official non-concessional commitments.

The independent expert group called last year for a larger fraction of concessional assistance to be channeled through MDBs. MDBs should provide an incremental US$260 billion of the additional annual official financing, of which $200 billion is non-concessional lending, and help mobilise and catalyse most of the associated private finance. MDB concessional financing should grow from US$30 billion in 2019 to US$90 billion in 2030.

These numbers illustrate that US$ 100 billion annual hydrogen investments require a judicious use of scarce concessional financing, and a well-coordinated approach is needed.

The 10 GW Lighthouse Initiative

It is clear that there is a need for additional concerted action to enable the proper hydrogen role for EMDC. There was a consensus during the Finance Forum that stakeholders need to cooperate more closely in order to get projects faster to FID. DFIs need to cooperate more closely to mobilise the necessary financing.

Given the finance scarcity and the number of projects in the pipeline, a careful evaluation is needed to identify projects that can reach FID in the coming years, and to design and implement the enabling measures to get them there. This will include the use of various innovative financing instruments. It is critical to learn from best practice, and identify blueprints on how to get there.

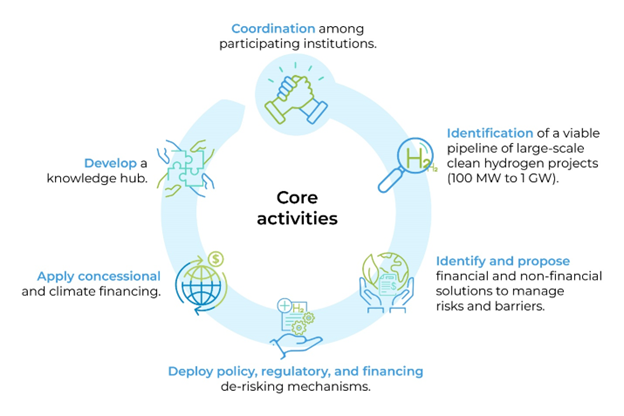

The 10 GW Lighthouse initiative, led by the World Bank Group in close cooperation with other Development Financing Institutions, was introduced and discussed during the forum. The goal is to get a significant number of mid-size hydrogen projects in EMDC to FID in the coming years. The proposed steps are illustrated in Figure 2. A similar virtuous cycle has been successfully deployed in the context of the World Bank work in scaling up clean energy to phase down coal.

Figure 2: “10 GW Lighthouse Initiative” virtuous cycle

Conclusion

The journey towards financing hydrogen projects in EMDC is fraught with challenges but also presents significant opportunities. By leveraging innovative financing solutions, de-risking strategies, and international collaboration, it is possible to bridge the financing gap and accelerate the development of clean hydrogen projects.

Fostering mutually beneficial collaboration with local and international partners and promoting knowledge transfer is critical. Better cooperation among MDBs and DFIs can maximise impact, avoid duplication of efforts and ensure complementarity of financial and technical support tools. Establishing partnerships across the entire Power-to-X value chain will accelerate deployment. The 10 GW Lighthouse initiative, along with supportive policies and technological advancements, can play a crucial role in driving the hydrogen economy forward, ensuring that EMDC can participate fully in the global energy transition.

***

Carolina Lopez Rocha is a Consultant at the World Bank Group

Dolf Gielen is the ESMAP lead for the Green Hydrogen Program at the World Bank Group

Chandrasekar Govindarajalu is the ESMAP Practice Manager at the World Bank Group

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://energypost.eu/financing-hydrogen-projects-in-emerging-markets-and-developing-countries/

Financing Hydrogen projects in Emerging Markets and Developing Countries – Energy Post

Republished by Plato

The financing gap

World Bank, OECD, Hydrogen Council and Global Infrastructure Facility highlighted in their joint report Scaling Hydrogen Financing for Development a pressing issue: Emerging Markets and Developing Countries (EMDC) need approximately US$ 100 billion annually for hydrogen investments between now and 2030. Around half of that amount is for renewable power generation. Electrolysers, downstream processing and enabling infrastructure account for the remainder.

Despite the growing recognition of the clean hydrogen potential to help achieve Paris targets, the current investment levels are far below what is required. BNEF has calculated that out of total global energy transition investments of US$ 1,769 billion, clean hydrogen investments amounted to US$10.4 billion in 2023, primarily in USA, Europe and China. Inclusion of the renewable energy component for hydrogen production could triple this figure but it is still a small share of total energy transition investments and an order of magnitude below EMDC investment needs. Thus, investment volumes fall short.

Clean hydrogen can be categorised into two main types: low-carbon hydrogen and renewable hydrogen. Low-carbon hydrogen is produced from natural gas with carbon capture and storage (CCS), whereas renewable hydrogen is produced from water electrolysis using renewable power sources like wind or solar energy. It is expected that renewable hydrogen will account for the major share. However, despite its environmental benefits, renewable hydrogen remains more expensive to produce than conventional hydrogen. This cost disparity poses a significant challenge for its widespread adoption and underscores the need for innovative financing solutions.

The production costs are determined by the capital intensity of the projects and the cost of financing. Our rule-of-thumb is 1-10-20-30: a million tonne per year of renewable hydrogen production capacity requires 10 GW electrolysers capacity, 20 GW renewable power and US$ 30 billion of investments.

Developing quality projects takes time. This was discussed in the forum. For example, the selected bidders participating in the H2Global’s pilot tender asked for more time than originally anticipated to submit their final bids. The quality and maturity of today’s projects varies widely, and this impacts the speed at which renewable hydrogen can be rolled out.

The economic viability gap and the need for innovation

The production cost of renewable hydrogen is a critical factor in its economic viability. Currently, the production cost stands at around US$3 per kilogram in the very best locations, which is three times the cost of conventional hydrogen production in good locations.

Average cost are considerably higher, as witnessed by the recent European auction results with LCOH of 5.3 to 5.8 EUR/kg (6 US$/kg) in Greece, Sweden and Spain and 11 to 13.5 EUR/kg (12 US$/kg) in Austria, Belgium, Denmark, France, Germany and Poland. The competitiveness of renewable hydrogen varies widely by country and even by location and it is influenced by factors such as natural gas prices and the availability of subsidies.

Conventional hydrogen production costs are determined by the natural gas price. Whereas natural gas feedstock costs 2 USD/GJ in the USA, the price is 8-15 USD/GJ in Europe or Japan. The geographical spread of successful European offers in the recent Hydrogen Bank auction reflects the importance of renewable resource quality for the production cost.

Subsidies and tax breaks

Also, subsidies and tax breaks can impact the project economics and production cost of renewable hydrogen substantially. In the US up to 3 US$/kg tax breaks will be provided for renewable hydrogen production, though the specific rules that apply are still debated. Globally around US$ 350 billion in hydrogen subsidies have been announced, according to BNEF. These subsidies are dominated by OECD countries and China.

Other EMDC do not have the same budgetary space. It is therefore no surprise that EMDC projects with Final Investment Decision (FID) account for less than 1 Mt annual production (Figure 1). According to the Hydrogen Council and McKinsey, 234 projects are in preparation in EMDCs, with LAC leading, followed by MENA, China, Africa and India. The size and the project types vary widely.

Figure 1: Status of global hydrogen project announcements / SOURCE: S&P Global Commodity Insights

Policies and regulations

Policies and regulations can impact the project investment needs. For example, hourly matching of renewable power supply and electrolysers operation requires the deployment of a mix of renewables including more costly supply options and possibly investments in electricity storage, or it can impact the number of operating hours of the electrolysers. Spatial matching of renewable power generation and electrolysis may require investments into more costly supply options. For example, offshore wind is twice as expensive as onshore wind, and onshore wind in good locations is again twice as expensive as solar PV per kWh of electricity produced. Further amendments and clarifications to the rules and regulations could improve uptake.

Technology cost reduction

Technology cost reduction will be critical to reduce hydrogen production cost. Chinese alkaline electrolysers sell at 962-1113 USD/1000 m3 (around 200 US/kW), PEM at roughly three times that price. Comparable uninstalled US PEM price is currently US$ 1000/kW, twice as much for installed systems. In the current geopolitical climate such differences may give rise to protectionism as countries vie for manufacturing market share. However innovation is another way to close the cost cap and accelerate renewable hydrogen deployment. The US government plans to drive the cost of PEM electrolysers to a quarter of their current cost within two years, targeting an uninstalled capital cost of US$250/kW for PEM by 2026 and US$100/kW by 2029-2036.

Renewable power costs

Renewable power costs determine renewable hydrogen costs. The capital intensity of wind and solar in combination with increasing financing costs have increased Power Purchasing Agreement prices in recent years. Whereas wind has seen significant cost increases as basic materials such as steel have increased in price, the cost of solar PV panels has continued to fall. In quarter one of 2024, PPA prices in Europe declined again by 5%. Further cost reductions will be critical. Falling electrolyser cost may allow in the future a daytime only operation mode so low-cost solar PV can become the main energy source. Limited opportunities exist elsewhere to deploy low-cost surplus hydropower, for example in the case of Paraguay.

In conclusion a wait-and-see approach will not get us the hydrogen deployment that we need. We also need learning-by-doing, which requires active support for initial projects and upscaling. And we need continued innovation to drive down technology costs.

Project financing structure

Renewable hydrogen projects are very capital intensive and have limited operating costs (if the renewable power supply is included in the project scope). The high CAPEX results in large upfront financing needs. As a consequence, the cost of financing is a critical factor that has a large impact on the production cost. The following discussion will focus on this specific factor.

Two types of projects can be identified: those that are on the books of large companies (corporate financing) and those that deploy a special purpose vehicle (SPV). An SPV is a subsidiary created by a parent company to isolate financial risk. This structure is widely used for energy projects and is considered the preferred approach for hydrogen projects. SPV’s economic and financial viability depends on the revenue stream and the offtake contract is therefore critical. However, SPVs require higher returns due to the perceived risks including those associated with new technologies and the nascent hydrogen sector.

Any new technology is considered risky and therefore faces elevated cost of financing. This is reflected in the debt-equity ratio that tends to be lower for new technologies. Whereas a solar PV project may be financed with 90% debt and 10% equity, a hydrogen project may require a 60% debt and 40% equity ratio. Equity is considerably more expensive than debt because of the elevated risk in terms of variable returns and the potential loss of the invested funds in case of default. Yet a minimum share of equity is determined by the project capability to meet debt servicing requirements from the revenue stream. In a developing country context debt may be priced at 8-10% while equity is priced at twice the price at 15-20%. A much higher cost of debt can occur in case of economic or political instability: the yield on sovereign bonds – generally seen as a lower bound for the cost of debt – can rise to 50% in countries that face a financial crisis.

Derisking as a strategy to reduce the cost of financing

Risks can be split into country specific risks common to all large infrastructure projects in EMDC and unique hydrogen specific risks. A renewable hydrogen project is especially sensitive to country risk because of its capital intensity. Once a hydrogen project is established, it is very costly to walk away or stop operating. The sensitivity to country specific risk factors is thus high. Guarantees can be deployed to reduce country risks. This is a well-established practice in other sectors.

Most early hydrogen projects have some kind of government involvement. EMDC government loan default rates have mostly been in the range of 2-4%, indicating the risks of lending to emerging markets are low. Moreover, recovery rates for private lenders in case of default were 74.7% between 1994 and 2022.

Most of the residual risks beyond the overall country risk are policy derived. Governments can mitigate such risks, using concessional financing or budget resources, through offtake agreements, demand guarantees, regulatory policy guarantees etc. But the prevalence of such structures is rare. A key explanation is that the guarantee needed to leverage the private sector is expensive.

Several risks influence the cost of capital for clean hydrogen projects. These specific risks centre on engineering, procurement, and construction (EPC) overruns, offtake default, technology nonperformance, withdrawal of regulatory incentives, and exchange rates. Implementing cost-effective and efficient de-risking mechanisms could substantially decrease the weighted average cost of capital, making projects economically viable, which will accelerate their deployment and reduce the financing gap.

During the Finance Forum, commercial banks reported their participation in the syndicated loans for NEOM in Saudi Arabia an H2GreenSteel in Sweden, two large renewable hydrogen projects that have reached FID. The syndication spreads out risks allowing a large number of financing institutions to get comfortable with hydrogen projects. The World Bank and OECD have performed a robust market sounding among financiers and developers around the world to map the main risks hindering the financing for clean hydrogen projects in EMDCs. The results show the prevalence of six subcategories of risks. In order of priority: offtake risks stand out, followed by equally weighted political and regulatory risks; infrastructure risks; permitting risks; technology risks; and finally macroeconomic risks. The lower sub-categories of risks are: design, construction and completion risks; operational and maintenance risks; and supply risks. In today’s nascent clean hydrogen industry, the degree of a particular project’s risk largely depends on the actors involved. Evaluating the credit rating, experience, and credibility of project sponsors, engineering, procurement, and construction (EPC) contractors, primary technology providers, and offtakers must feature prominently in any risk assessment. As such, it is critical that EMDC governments select reputable partners.

How risks translate into cost of financing is not entirely clear. Data for individual projects and the risk calculation behind such projects are usually confidential and there is no uniform methodology to assess risk. Financial ratings of companies and countries provide some guidance but are not always available or directly applicable. More transparency regarding financing costs can help to drive costs down.

Risk mitigation mechanisms can help large-scale clean hydrogen projects in EMDC achieve financial viability. Policy de-risking mechanisms aim at removing the root causes of risks through policy measures. They include instruments to support institutional capacity building, local skills development, the implementation of relevant laws, and the management of infrastructure assets. Financial de-risking mechanisms deploy financial measures to avoid or reduce project risk.

Governments of EMDC can collaborate with development finance institutions to devise and implement a wide spectrum of financial de-risking instruments for clean hydrogen projects, tailored to the needs and characteristics of each country. Such instruments include partial credit guarantees, partial risk guarantees, political risk insurance, liquidity reserve accounts, and local currency support.

Export credit agencies have traditionally guaranteed investments abroad and have already played a role in first projects such as NEOM in Saudi Arabia. The Dutch government commented during the Finance Forum that there is an intent to change the Dutch Export Credit Agency (ECA, Atradius) rule so having Netherlands as a target market for exports will be sufficient for the Dutch ECA to cover non-OECD risks.

Also, insurers can provide technology performance insurances and have already done so for electrolysers. They can also insure against natural disasters.

Whereas such guarantees and insurances can help to reduce the financing needs, this is not a panacea. For example, a balance needs to be struck between financing cost reductions and the cost of the risk mitigation instruments. For example, MIGA political risk insurance and credit enhancement for cross-border private sector investors and lenders is particularly relevant for investments in countries with specific credit rating.

Finally, there is a need to consider proper risk allocation. Project partners and stakeholders may play a specific role, for example in terms of offtake risk guarantee, technology performance risk and EPC wrap.

Is the market willing to pay for renewable Hydrogen from EMDC?

A key insight from the Rotterdam World Hydrogen Summit was that demand falls short. The Hydrogen Council presented that implementation of today’s announced incentives will yield 3-7 Mt hydrogen demand while demand side policy targets add up to 27 Mt hydrogen demand. Private sector players commented during the Summit that the realisation of 20 Mt hydrogen demand in Europe seems unlikely. This puts the European 10 Mt import target into jeopardy. Given the preference for low-cost and low-carbon hydrogen in Korea and Japan – ideally from subsidised US production – this raises the question who will buy EMDC renewable hydrogen from projects that target exports.

Whereas focus is on the cost side, the revenue generated is also key for economic performance. This revenue stream depends on the offtake contract. The first European Hydrogen Bank auction has shown impressively that favorable offtake opportunities exist where even today less than 0.5 EUR/kg subsidies are needed for an economically viable project, with total production cost in the 5-6 Euro range. Some parties are thus willing to pay such an elevated price, which may help to get the market going. A recent announcement of an ‘ammonia for shipping’ project in Namibia illustrates the key importance of this demand sector for EMDC hydrogen development in the coming years.

H2Global has recently received 3.8 billion euros in additional funding from the German and Dutch governments and will soon launch the first results of its pilot auction. The European Hydrogen Bank relies on the member countries to shape and operationalise imports, using instruments such as H2Global.

In conclusion demand policies need to be strengthened in order to realise the desired hydrogen uptake and foster EMDC production.

The role of blended financing

One solution that is often touted is blended financing. This comes in four blending archetypes:

Concessional financing is anything below market rates. It is often viewed in Overseas Development Assistance (ODA) terms, although IBRD (World Bank financing), which is often labeled non-concessional, is also below market rates.

Yet the Independent Expert Group on Climate Finance concluded that the use of “blended finance,” deployed transaction-by-transaction in a bespoke fashion, has not proven scalable so far. Convergence reports that blended financing totals grew to US$15 billion in 2023, reaching a 5-year high. Commercial financing from DFIs/MDBs grew by 140% to US$4.9 billion in 2023. This is complemented with nearly US$1 billion in ODA, including funds channeled through DFI/MDBs. The use of concessional guarantees and risk insurance is on the rise — the dollar value of concessional guarantees accounted for 43% of all concessional funding in 2023. The energy sector accounts for nearly one third of deal activity and 47% of total blended capital flows. Much of this investment targets renewable energy development.

The OECD applies a broader blended financing definition and reports thus larger sums. According to the OECD, the two leveraging mechanisms (or archetypes) that mobilised the largest volumes of private capital were direct investment in companies and project finance special purpose vehicles (SPVs) (US$13.8 billion) and guarantees (US$9.8 billion). OECD estimated a total of US$61 billion of blended finance as of 2022.

The World Bank has calculated that private sector investments in infrastructure, or private participation in infrastructure (PPI) in EMDC amounted to US$86 billion in 2023. Energy projects represent a large chunk and energy saw a threefold increase in investment levels in 2023. A fifth of the funding came from DFIs (MBDs, bilateral development agencies, ECAs), and 13 percent from public sources.

According to the Independent Expert Group the non-sovereign arms of MDBs, even with the sweeteners of donor-funded concessional finance, only mobilised 64 cents in private finance per dollar of MDB plus concessional commitments. Historically the leverage ratio of transactions is higher (2.5-5.1) when there is market-rate participation from a DFI or MDB. It is therefore evident that DFIs and MDBs, with their limited asset bases, can only drive blended finance growth so much.

Concessional resources should be used only when they create the virtuous cycle, not to “compensate” for bad policies. Also the level of concessionality matters. For example, the World Bank Group follows a rigorous model to ensure minimal concessionality, reducing the likelihood of market distortions.

Official non-concessional finance is the engine for scaling up sustainable development investments in middle-income countries. MDBs are the backbone of the non-concessional official financing architecture, accounting for over 60 percent of the system (around US$100 billion per year). Bilateral agencies are also important but in aggregate account for only one quarter of official non-concessional commitments.

The independent expert group called last year for a larger fraction of concessional assistance to be channeled through MDBs. MDBs should provide an incremental US$260 billion of the additional annual official financing, of which $200 billion is non-concessional lending, and help mobilise and catalyse most of the associated private finance. MDB concessional financing should grow from US$30 billion in 2019 to US$90 billion in 2030.

These numbers illustrate that US$ 100 billion annual hydrogen investments require a judicious use of scarce concessional financing, and a well-coordinated approach is needed.

The 10 GW Lighthouse Initiative

It is clear that there is a need for additional concerted action to enable the proper hydrogen role for EMDC. There was a consensus during the Finance Forum that stakeholders need to cooperate more closely in order to get projects faster to FID. DFIs need to cooperate more closely to mobilise the necessary financing.

Given the finance scarcity and the number of projects in the pipeline, a careful evaluation is needed to identify projects that can reach FID in the coming years, and to design and implement the enabling measures to get them there. This will include the use of various innovative financing instruments. It is critical to learn from best practice, and identify blueprints on how to get there.

The 10 GW Lighthouse initiative, led by the World Bank Group in close cooperation with other Development Financing Institutions, was introduced and discussed during the forum. The goal is to get a significant number of mid-size hydrogen projects in EMDC to FID in the coming years. The proposed steps are illustrated in Figure 2. A similar virtuous cycle has been successfully deployed in the context of the World Bank work in scaling up clean energy to phase down coal.

Figure 2: “10 GW Lighthouse Initiative” virtuous cycle

Conclusion

The journey towards financing hydrogen projects in EMDC is fraught with challenges but also presents significant opportunities. By leveraging innovative financing solutions, de-risking strategies, and international collaboration, it is possible to bridge the financing gap and accelerate the development of clean hydrogen projects.

Fostering mutually beneficial collaboration with local and international partners and promoting knowledge transfer is critical. Better cooperation among MDBs and DFIs can maximise impact, avoid duplication of efforts and ensure complementarity of financial and technical support tools. Establishing partnerships across the entire Power-to-X value chain will accelerate deployment. The 10 GW Lighthouse initiative, along with supportive policies and technological advancements, can play a crucial role in driving the hydrogen economy forward, ensuring that EMDC can participate fully in the global energy transition.

***

Carolina Lopez Rocha is a Consultant at the World Bank Group

Dolf Gielen is the ESMAP lead for the Green Hydrogen Program at the World Bank Group

Chandrasekar Govindarajalu is the ESMAP Practice Manager at the World Bank Group

The Energy Transition Rocks

Li Auto plans to open its 1st overseas after-sales service store in Kazakhstan this month, report says

Hydrogen trucks retreat from Australia as battery electric sales surge

Federal Judge Orders Biden Admin to Restart LNG Export Process – EcoWatch

Jamaica braces for Hurricane Beryl as storm thrashes Caribbean and targets US: Live

More on “Age of the Earth”

Age of the Earth

Canadians Embrace Electric Vehicles with Government Backing

Cost Breakdown of Installing Solar Panels in Australia

U.S. Supreme Court Clobbers Democracy – IV Words – The Progressive Perspective